Tap to Pay on iPhone

Accept contactless payments right on your iPhone with the Mollie app

Accept payments

Embedded payments

Grow your business

Technical resources

About Mollie

Tap to Pay on iPhone

Accept contactless payments right on your iPhone with the Mollie app

Accept payments

Embedded payments

Grow your business

Technical resources

About Mollie

Tap to Pay on iPhone

Accept contactless payments right on your iPhone with the Mollie app

Accept payments

Embedded payments

Grow your business

Technical resources

About Mollie

What is fraud detection?

What is fraud detection?

What is fraud detection?

What is fraud detection and how does it work? Discover how fraud can impact your business and how to prevent it.

What is fraud detection and how does it work? Discover how fraud can impact your business and how to prevent it.

Feb 20, 2023

Why fraud detection is important

In ecommerce, it’s essential to prevent fraud to ensure your business is healthy. After all, if you’re leaking money or regularly targeted by scammers, your profitability is in serious danger. You’ll also struggle to maintain a healthy cash flow.

Simply put: fraud prevention measures help you determine that transactions are legitimate and that customers really are who they say they are. Both are vital to your business’s success.

So, how can effective fraud detection help you stop losing money and reduce unnecessary costs?

Let’s take a look.

Increase authorisation rates

Your authorisation rate – also known as your approval ratio or auth rate – is the percentage of your transactions that are approved during the authorisation process.

For most card payments, the issuing bank – or the consumer’s bank that issued the card – has to review and authorise a transaction before sending funds to your business.

If your business is subject to a high amount of unauthorised transactions, issuing banks will eventually see it as high risk and decline higher numbers of attempted payments. This can lead to more cart abandonments as customers might not retry a failed payment or lose trust in you.

In fact, our data shows that 54% of consumers would abandon a purchase if they didn’t feel the payment was secure. It can also lead to more false declines, which are legitimate transactions that get blocked due to suspected fraud.

So, how can a robust fraud detection strategy help?

It will help you ensure payments are legitimate, increasing your authorisation rate, decreasing friction during checkout, and driving revenue.

Avoid monitoring programs

If your business is prone to fraud and chargebacks, some card schemes – or the companies that run card networks such as Visa or Mastercard – may place you on a monitoring program. These are the two types of programs:

Fraud monitoring

Chargeback monitoring

These programs incentivise you to reduce fraud and chargebacks and will often impose penalties if you don’t. These penalties include making you pay higher fees or fines, and sometimes even preventing you from processing payments altogether.

Avoiding being subject to one of these monitoring programs will help you control costs and – in extreme cases – even help your business keep trading.

Reduce chargebacks

If fraud detection is part of your business’s armour, chargebacks are the shield that helps to protect consumers from online scammers.

Chargebacks can be initiated for several reasons, including valid issues such as defective products or incorrect charges. But they can also be caused by fraudsters stealing a cardholder’s details and using them illegally. If this happens, the card’s owner will file a chargeback to get the funds back.

No matter the cause, chargebacks cost your business money and time: you have to pay fees, contest the dispute, and you might also lose the cost of the products or services delivered.

If you have a high rate of chargebacks, you can also face other problems, including lower authorisation rates, higher fines, increased payment processing fees, and even account closure.

Preventing fraud can help you block fraudulent chargebacks – protecting your business from the dangers that come with them.

In ecommerce, it’s essential to prevent fraud to ensure your business is healthy. After all, if you’re leaking money or regularly targeted by scammers, your profitability is in serious danger. You’ll also struggle to maintain a healthy cash flow.

Simply put: fraud prevention measures help you determine that transactions are legitimate and that customers really are who they say they are. Both are vital to your business’s success.

So, how can effective fraud detection help you stop losing money and reduce unnecessary costs?

Let’s take a look.

Increase authorisation rates

Your authorisation rate – also known as your approval ratio or auth rate – is the percentage of your transactions that are approved during the authorisation process.

For most card payments, the issuing bank – or the consumer’s bank that issued the card – has to review and authorise a transaction before sending funds to your business.

If your business is subject to a high amount of unauthorised transactions, issuing banks will eventually see it as high risk and decline higher numbers of attempted payments. This can lead to more cart abandonments as customers might not retry a failed payment or lose trust in you.

In fact, our data shows that 54% of consumers would abandon a purchase if they didn’t feel the payment was secure. It can also lead to more false declines, which are legitimate transactions that get blocked due to suspected fraud.

So, how can a robust fraud detection strategy help?

It will help you ensure payments are legitimate, increasing your authorisation rate, decreasing friction during checkout, and driving revenue.

Avoid monitoring programs

If your business is prone to fraud and chargebacks, some card schemes – or the companies that run card networks such as Visa or Mastercard – may place you on a monitoring program. These are the two types of programs:

Fraud monitoring

Chargeback monitoring

These programs incentivise you to reduce fraud and chargebacks and will often impose penalties if you don’t. These penalties include making you pay higher fees or fines, and sometimes even preventing you from processing payments altogether.

Avoiding being subject to one of these monitoring programs will help you control costs and – in extreme cases – even help your business keep trading.

Reduce chargebacks

If fraud detection is part of your business’s armour, chargebacks are the shield that helps to protect consumers from online scammers.

Chargebacks can be initiated for several reasons, including valid issues such as defective products or incorrect charges. But they can also be caused by fraudsters stealing a cardholder’s details and using them illegally. If this happens, the card’s owner will file a chargeback to get the funds back.

No matter the cause, chargebacks cost your business money and time: you have to pay fees, contest the dispute, and you might also lose the cost of the products or services delivered.

If you have a high rate of chargebacks, you can also face other problems, including lower authorisation rates, higher fines, increased payment processing fees, and even account closure.

Preventing fraud can help you block fraudulent chargebacks – protecting your business from the dangers that come with them.

In ecommerce, it’s essential to prevent fraud to ensure your business is healthy. After all, if you’re leaking money or regularly targeted by scammers, your profitability is in serious danger. You’ll also struggle to maintain a healthy cash flow.

Simply put: fraud prevention measures help you determine that transactions are legitimate and that customers really are who they say they are. Both are vital to your business’s success.

So, how can effective fraud detection help you stop losing money and reduce unnecessary costs?

Let’s take a look.

Increase authorisation rates

Your authorisation rate – also known as your approval ratio or auth rate – is the percentage of your transactions that are approved during the authorisation process.

For most card payments, the issuing bank – or the consumer’s bank that issued the card – has to review and authorise a transaction before sending funds to your business.

If your business is subject to a high amount of unauthorised transactions, issuing banks will eventually see it as high risk and decline higher numbers of attempted payments. This can lead to more cart abandonments as customers might not retry a failed payment or lose trust in you.

In fact, our data shows that 54% of consumers would abandon a purchase if they didn’t feel the payment was secure. It can also lead to more false declines, which are legitimate transactions that get blocked due to suspected fraud.

So, how can a robust fraud detection strategy help?

It will help you ensure payments are legitimate, increasing your authorisation rate, decreasing friction during checkout, and driving revenue.

Avoid monitoring programs

If your business is prone to fraud and chargebacks, some card schemes – or the companies that run card networks such as Visa or Mastercard – may place you on a monitoring program. These are the two types of programs:

Fraud monitoring

Chargeback monitoring

These programs incentivise you to reduce fraud and chargebacks and will often impose penalties if you don’t. These penalties include making you pay higher fees or fines, and sometimes even preventing you from processing payments altogether.

Avoiding being subject to one of these monitoring programs will help you control costs and – in extreme cases – even help your business keep trading.

Reduce chargebacks

If fraud detection is part of your business’s armour, chargebacks are the shield that helps to protect consumers from online scammers.

Chargebacks can be initiated for several reasons, including valid issues such as defective products or incorrect charges. But they can also be caused by fraudsters stealing a cardholder’s details and using them illegally. If this happens, the card’s owner will file a chargeback to get the funds back.

No matter the cause, chargebacks cost your business money and time: you have to pay fees, contest the dispute, and you might also lose the cost of the products or services delivered.

If you have a high rate of chargebacks, you can also face other problems, including lower authorisation rates, higher fines, increased payment processing fees, and even account closure.

Preventing fraud can help you block fraudulent chargebacks – protecting your business from the dangers that come with them.

In ecommerce, it’s essential to prevent fraud to ensure your business is healthy. After all, if you’re leaking money or regularly targeted by scammers, your profitability is in serious danger. You’ll also struggle to maintain a healthy cash flow.

Simply put: fraud prevention measures help you determine that transactions are legitimate and that customers really are who they say they are. Both are vital to your business’s success.

So, how can effective fraud detection help you stop losing money and reduce unnecessary costs?

Let’s take a look.

Increase authorisation rates

Your authorisation rate – also known as your approval ratio or auth rate – is the percentage of your transactions that are approved during the authorisation process.

For most card payments, the issuing bank – or the consumer’s bank that issued the card – has to review and authorise a transaction before sending funds to your business.

If your business is subject to a high amount of unauthorised transactions, issuing banks will eventually see it as high risk and decline higher numbers of attempted payments. This can lead to more cart abandonments as customers might not retry a failed payment or lose trust in you.

In fact, our data shows that 54% of consumers would abandon a purchase if they didn’t feel the payment was secure. It can also lead to more false declines, which are legitimate transactions that get blocked due to suspected fraud.

So, how can a robust fraud detection strategy help?

It will help you ensure payments are legitimate, increasing your authorisation rate, decreasing friction during checkout, and driving revenue.

Avoid monitoring programs

If your business is prone to fraud and chargebacks, some card schemes – or the companies that run card networks such as Visa or Mastercard – may place you on a monitoring program. These are the two types of programs:

Fraud monitoring

Chargeback monitoring

These programs incentivise you to reduce fraud and chargebacks and will often impose penalties if you don’t. These penalties include making you pay higher fees or fines, and sometimes even preventing you from processing payments altogether.

Avoiding being subject to one of these monitoring programs will help you control costs and – in extreme cases – even help your business keep trading.

Reduce chargebacks

If fraud detection is part of your business’s armour, chargebacks are the shield that helps to protect consumers from online scammers.

Chargebacks can be initiated for several reasons, including valid issues such as defective products or incorrect charges. But they can also be caused by fraudsters stealing a cardholder’s details and using them illegally. If this happens, the card’s owner will file a chargeback to get the funds back.

No matter the cause, chargebacks cost your business money and time: you have to pay fees, contest the dispute, and you might also lose the cost of the products or services delivered.

If you have a high rate of chargebacks, you can also face other problems, including lower authorisation rates, higher fines, increased payment processing fees, and even account closure.

Preventing fraud can help you block fraudulent chargebacks – protecting your business from the dangers that come with them.

How does fraud detection work?

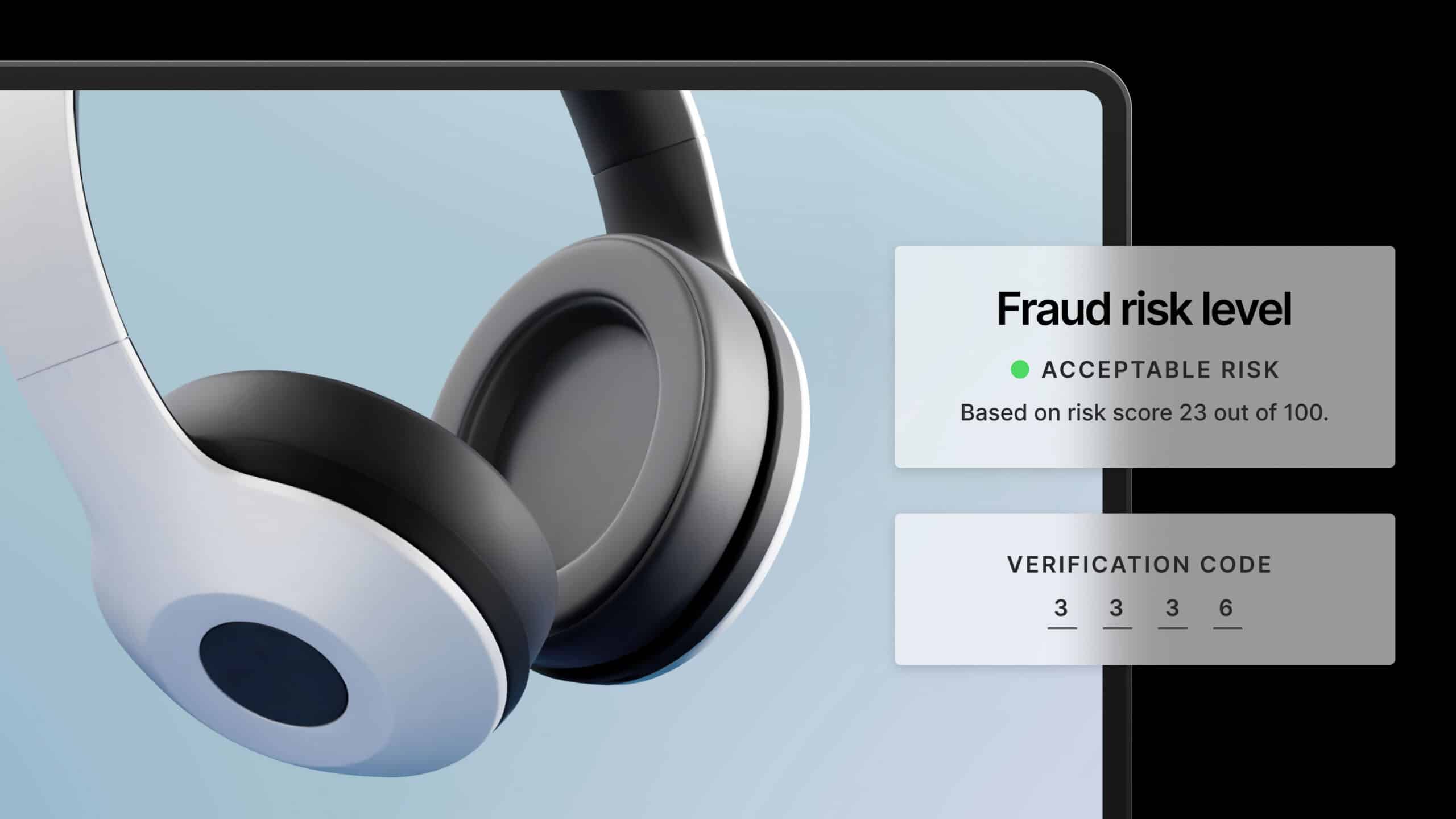

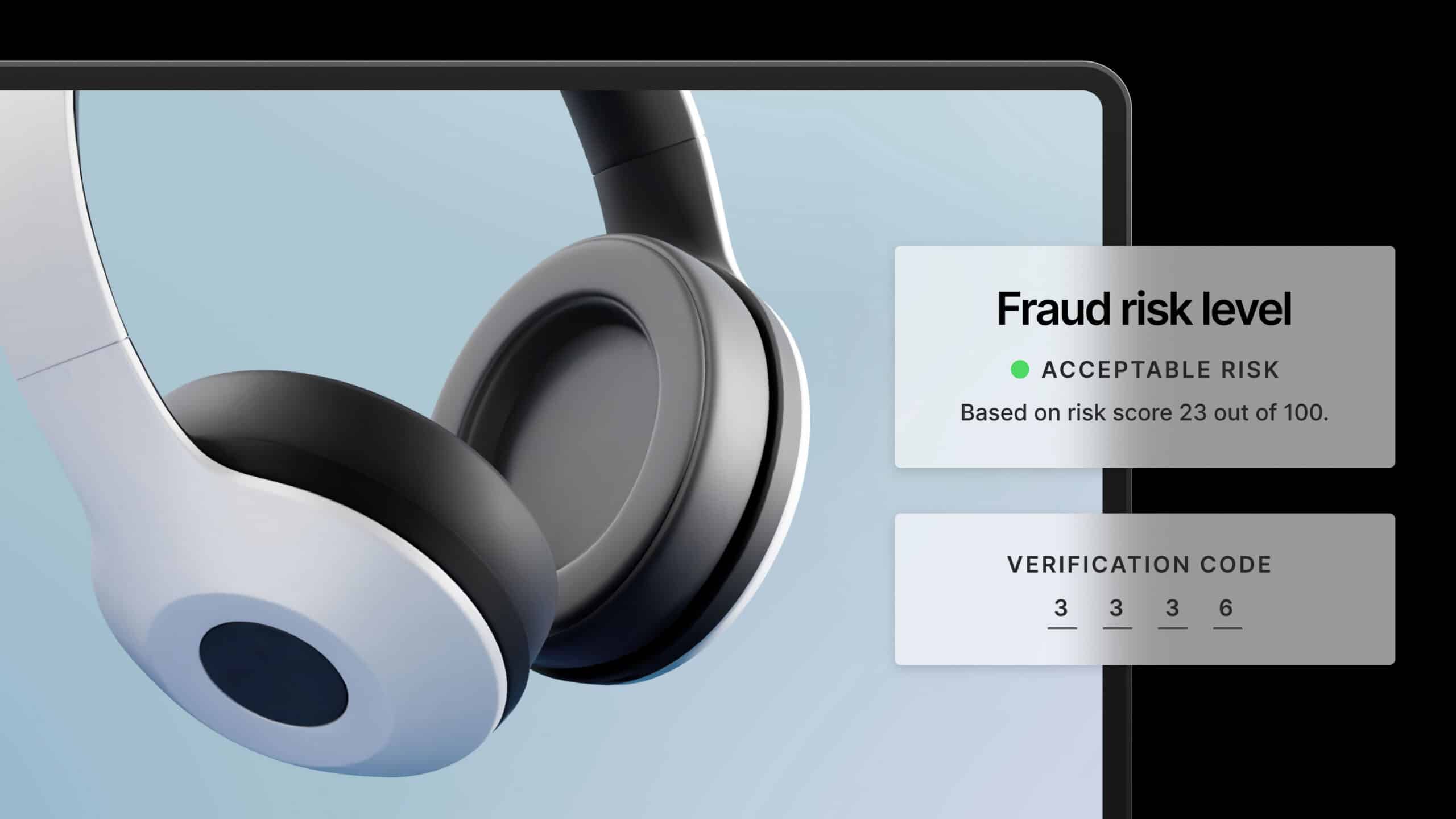

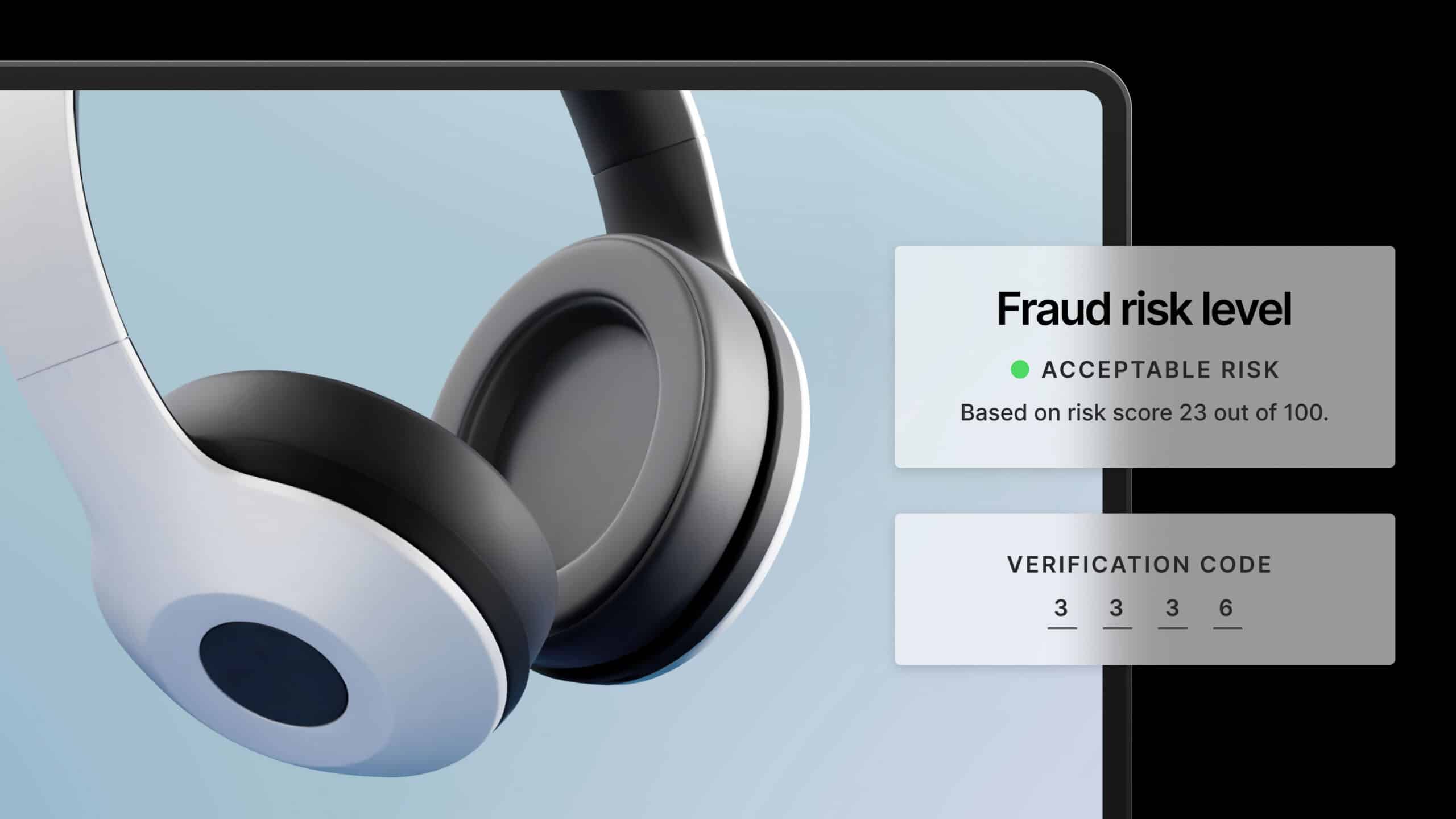

Fraudsters are constantly adapting their techniques, and so are the technologies used to catch them. That means most modern fraud detection systems use AI, machine learning, and statistical techniques such as data collection, preparation, and analysis to identify fraud and unauthorised behaviour.

They are usually always running to flag potentially fraudulent activity automatically. When that happens, they either increase authentication security or block a transaction altogether.

One way to quickly add fraud detection to your card payments is to work with a payment service provider that offers it. Here at Mollie, we provide advanced services that help our customers maximise acceptance and conversion rates while minimising fraud risk.

Want to turn on machine-learning-powered fraud screening for every transaction so you’re always protected? We offer that.

Or do you want a bit more control? Like the ability to configure your fraud tools (with guidance if needed) to fine-tune performance. We offer that as well.

Fraudsters are constantly adapting their techniques, and so are the technologies used to catch them. That means most modern fraud detection systems use AI, machine learning, and statistical techniques such as data collection, preparation, and analysis to identify fraud and unauthorised behaviour.

They are usually always running to flag potentially fraudulent activity automatically. When that happens, they either increase authentication security or block a transaction altogether.

One way to quickly add fraud detection to your card payments is to work with a payment service provider that offers it. Here at Mollie, we provide advanced services that help our customers maximise acceptance and conversion rates while minimising fraud risk.

Want to turn on machine-learning-powered fraud screening for every transaction so you’re always protected? We offer that.

Or do you want a bit more control? Like the ability to configure your fraud tools (with guidance if needed) to fine-tune performance. We offer that as well.

Fraudsters are constantly adapting their techniques, and so are the technologies used to catch them. That means most modern fraud detection systems use AI, machine learning, and statistical techniques such as data collection, preparation, and analysis to identify fraud and unauthorised behaviour.

They are usually always running to flag potentially fraudulent activity automatically. When that happens, they either increase authentication security or block a transaction altogether.

One way to quickly add fraud detection to your card payments is to work with a payment service provider that offers it. Here at Mollie, we provide advanced services that help our customers maximise acceptance and conversion rates while minimising fraud risk.

Want to turn on machine-learning-powered fraud screening for every transaction so you’re always protected? We offer that.

Or do you want a bit more control? Like the ability to configure your fraud tools (with guidance if needed) to fine-tune performance. We offer that as well.

Fraudsters are constantly adapting their techniques, and so are the technologies used to catch them. That means most modern fraud detection systems use AI, machine learning, and statistical techniques such as data collection, preparation, and analysis to identify fraud and unauthorised behaviour.

They are usually always running to flag potentially fraudulent activity automatically. When that happens, they either increase authentication security or block a transaction altogether.

One way to quickly add fraud detection to your card payments is to work with a payment service provider that offers it. Here at Mollie, we provide advanced services that help our customers maximise acceptance and conversion rates while minimising fraud risk.

Want to turn on machine-learning-powered fraud screening for every transaction so you’re always protected? We offer that.

Or do you want a bit more control? Like the ability to configure your fraud tools (with guidance if needed) to fine-tune performance. We offer that as well.

How to prevent ecommerce fraud

If it wasn’t clear, having fraud detection systems in place could be the difference between your business making or losing money – or, in extreme cases, even closing completely. But as scammers constantly adapt their techniques and work out new ways to steal, there’s no quick fix to stop fraud.

Though completely stopping fraud isn’t easy, there are things you can do to help prevent your business from being caught out, including these things:

Regularly check your site security

It might seem obvious, but doing a regular site security audit will help you identify where fraudsters might target. Try these things:

Scan your site for malware

Make sure you’re encrypting messages with customers and suppliers

Update your plugins and software

Back up data in a secure place

Check and change passwords to make sure they’re secure

Make sure you’re PCI DSS compliant

PCI DSS stands for Payment Card Industry Data Security Standards. You must adhere to these payment security guidelines when processing credit card payments. You can only save your customers’ credit card information if you are PCI-DSS certified. Working with a payment service provider can help make sure you always comply with the appropriate security regulations, including PCI DSS protocols.

Use an Address Verification Service (AVS)

Address Verification Services detect suspicious credit card transactions to prevent fraud. They check the billing address submitted during a credit card payment to ensure that it matches the billing address registered with the issuing bank. When the addresses don’t match, the payment processor can decline a payment or ask for further verification before authorisation.

Watch out for phishing

Phishing is a type of online fraud scammers use to trick you (or people in your company) into sharing sensitive information or installing malware by pretending to be a trusted person or organisation. Ensure you don’t fall victim to a phishing attack by always flagging potentially risky messages and helping others identify potentially dangerous emails.

If it wasn’t clear, having fraud detection systems in place could be the difference between your business making or losing money – or, in extreme cases, even closing completely. But as scammers constantly adapt their techniques and work out new ways to steal, there’s no quick fix to stop fraud.

Though completely stopping fraud isn’t easy, there are things you can do to help prevent your business from being caught out, including these things:

Regularly check your site security

It might seem obvious, but doing a regular site security audit will help you identify where fraudsters might target. Try these things:

Scan your site for malware

Make sure you’re encrypting messages with customers and suppliers

Update your plugins and software

Back up data in a secure place

Check and change passwords to make sure they’re secure

Make sure you’re PCI DSS compliant

PCI DSS stands for Payment Card Industry Data Security Standards. You must adhere to these payment security guidelines when processing credit card payments. You can only save your customers’ credit card information if you are PCI-DSS certified. Working with a payment service provider can help make sure you always comply with the appropriate security regulations, including PCI DSS protocols.

Use an Address Verification Service (AVS)

Address Verification Services detect suspicious credit card transactions to prevent fraud. They check the billing address submitted during a credit card payment to ensure that it matches the billing address registered with the issuing bank. When the addresses don’t match, the payment processor can decline a payment or ask for further verification before authorisation.

Watch out for phishing

Phishing is a type of online fraud scammers use to trick you (or people in your company) into sharing sensitive information or installing malware by pretending to be a trusted person or organisation. Ensure you don’t fall victim to a phishing attack by always flagging potentially risky messages and helping others identify potentially dangerous emails.

If it wasn’t clear, having fraud detection systems in place could be the difference between your business making or losing money – or, in extreme cases, even closing completely. But as scammers constantly adapt their techniques and work out new ways to steal, there’s no quick fix to stop fraud.

Though completely stopping fraud isn’t easy, there are things you can do to help prevent your business from being caught out, including these things:

Regularly check your site security

It might seem obvious, but doing a regular site security audit will help you identify where fraudsters might target. Try these things:

Scan your site for malware

Make sure you’re encrypting messages with customers and suppliers

Update your plugins and software

Back up data in a secure place

Check and change passwords to make sure they’re secure

Make sure you’re PCI DSS compliant

PCI DSS stands for Payment Card Industry Data Security Standards. You must adhere to these payment security guidelines when processing credit card payments. You can only save your customers’ credit card information if you are PCI-DSS certified. Working with a payment service provider can help make sure you always comply with the appropriate security regulations, including PCI DSS protocols.

Use an Address Verification Service (AVS)

Address Verification Services detect suspicious credit card transactions to prevent fraud. They check the billing address submitted during a credit card payment to ensure that it matches the billing address registered with the issuing bank. When the addresses don’t match, the payment processor can decline a payment or ask for further verification before authorisation.

Watch out for phishing

Phishing is a type of online fraud scammers use to trick you (or people in your company) into sharing sensitive information or installing malware by pretending to be a trusted person or organisation. Ensure you don’t fall victim to a phishing attack by always flagging potentially risky messages and helping others identify potentially dangerous emails.

If it wasn’t clear, having fraud detection systems in place could be the difference between your business making or losing money – or, in extreme cases, even closing completely. But as scammers constantly adapt their techniques and work out new ways to steal, there’s no quick fix to stop fraud.

Though completely stopping fraud isn’t easy, there are things you can do to help prevent your business from being caught out, including these things:

Regularly check your site security

It might seem obvious, but doing a regular site security audit will help you identify where fraudsters might target. Try these things:

Scan your site for malware

Make sure you’re encrypting messages with customers and suppliers

Update your plugins and software

Back up data in a secure place

Check and change passwords to make sure they’re secure

Make sure you’re PCI DSS compliant

PCI DSS stands for Payment Card Industry Data Security Standards. You must adhere to these payment security guidelines when processing credit card payments. You can only save your customers’ credit card information if you are PCI-DSS certified. Working with a payment service provider can help make sure you always comply with the appropriate security regulations, including PCI DSS protocols.

Use an Address Verification Service (AVS)

Address Verification Services detect suspicious credit card transactions to prevent fraud. They check the billing address submitted during a credit card payment to ensure that it matches the billing address registered with the issuing bank. When the addresses don’t match, the payment processor can decline a payment or ask for further verification before authorisation.

Watch out for phishing

Phishing is a type of online fraud scammers use to trick you (or people in your company) into sharing sensitive information or installing malware by pretending to be a trusted person or organisation. Ensure you don’t fall victim to a phishing attack by always flagging potentially risky messages and helping others identify potentially dangerous emails.

Use fraud detection to protect your business

Fraud detection is more than just a nice-to-have for your business. You’ll increase conversion, boost revenue, and reduce costs by ensuring you have the proper defences in place. It will also protect both your business and customers from attacks.

There are things you can do to make sure your business is safe, but working with the right partners is one of the best ways to make sure you stop fraud without having to worry about the constant (and often complex) work of fighting fraudulent activities.

Here at Mollie, we provide advanced tools to help you reduce fraud and optimise acceptance to drive revenue. That includes screening, performance insights, risk assessments, and dynamic 3D Secure features. Save time and money by stopping fraud before a payment goes through while reducing friction for your trusted customers.

As well as that, we offer a complete payments solution that provides:

A best-in-class checkout

Leading and local payment methods

Fast and Flexible funding

Advanced money management tools

Want to learn more about how we can help your business? Take a tour of our advanced payments solution with our product demo.

Fraud detection is more than just a nice-to-have for your business. You’ll increase conversion, boost revenue, and reduce costs by ensuring you have the proper defences in place. It will also protect both your business and customers from attacks.

There are things you can do to make sure your business is safe, but working with the right partners is one of the best ways to make sure you stop fraud without having to worry about the constant (and often complex) work of fighting fraudulent activities.

Here at Mollie, we provide advanced tools to help you reduce fraud and optimise acceptance to drive revenue. That includes screening, performance insights, risk assessments, and dynamic 3D Secure features. Save time and money by stopping fraud before a payment goes through while reducing friction for your trusted customers.

As well as that, we offer a complete payments solution that provides:

A best-in-class checkout

Leading and local payment methods

Fast and Flexible funding

Advanced money management tools

Want to learn more about how we can help your business? Take a tour of our advanced payments solution with our product demo.

Fraud detection is more than just a nice-to-have for your business. You’ll increase conversion, boost revenue, and reduce costs by ensuring you have the proper defences in place. It will also protect both your business and customers from attacks.

There are things you can do to make sure your business is safe, but working with the right partners is one of the best ways to make sure you stop fraud without having to worry about the constant (and often complex) work of fighting fraudulent activities.

Here at Mollie, we provide advanced tools to help you reduce fraud and optimise acceptance to drive revenue. That includes screening, performance insights, risk assessments, and dynamic 3D Secure features. Save time and money by stopping fraud before a payment goes through while reducing friction for your trusted customers.

As well as that, we offer a complete payments solution that provides:

A best-in-class checkout

Leading and local payment methods

Fast and Flexible funding

Advanced money management tools

Want to learn more about how we can help your business? Take a tour of our advanced payments solution with our product demo.

Fraud detection is more than just a nice-to-have for your business. You’ll increase conversion, boost revenue, and reduce costs by ensuring you have the proper defences in place. It will also protect both your business and customers from attacks.

There are things you can do to make sure your business is safe, but working with the right partners is one of the best ways to make sure you stop fraud without having to worry about the constant (and often complex) work of fighting fraudulent activities.

Here at Mollie, we provide advanced tools to help you reduce fraud and optimise acceptance to drive revenue. That includes screening, performance insights, risk assessments, and dynamic 3D Secure features. Save time and money by stopping fraud before a payment goes through while reducing friction for your trusted customers.

As well as that, we offer a complete payments solution that provides:

A best-in-class checkout

Leading and local payment methods

Fast and Flexible funding

Advanced money management tools

Want to learn more about how we can help your business? Take a tour of our advanced payments solution with our product demo.

More updates

What is friendly fraud?

Friendly fraud can cause financial loss, admin headaches, and reputational risk. Explore different types of friendly fraud and how to prevent chargebacks.

How to prevent carding attacks

Learn how to prevent carding attacks. Discover key prevention strategies and how fraud prevention solutions can safeguard your business.

Are consumers taking back control of their data?

Happy Horizon and Mollie are putting their heads together with 23 experts about personal data.

Ecommerce fraud management strategies

Discover ecommerce fraud management strategies and how to protect your business from fraudsters.

What is friendly fraud?

Friendly fraud can cause financial loss, admin headaches, and reputational risk. Explore different types of friendly fraud and how to prevent chargebacks.

How to prevent carding attacks

Learn how to prevent carding attacks. Discover key prevention strategies and how fraud prevention solutions can safeguard your business.

Are consumers taking back control of their data?

Happy Horizon and Mollie are putting their heads together with 23 experts about personal data.

Ecommerce fraud management strategies

Discover ecommerce fraud management strategies and how to protect your business from fraudsters.

Stay up to date

Never miss an update. Receive product updates, news and customer stories right into your inbox.

Stay up to date

Never miss an update. Receive product updates, news and customer stories right into your inbox.

Connect every payment. Upgrade every part of your business.

Never miss an update. Receive product updates, news and customer stories right into your inbox.

Stay up to date

Never miss an update. Receive product updates, news and customer stories right into your inbox.

Table of contents

Table of contents

Table of contents

Table of contents

Simplify payments and money management

Drive revenue, reduce costs, and manage funds with Mollie.

Simplify payments and money management

Whether you want to grow internationally or focus on a specific market, everything is possible. Mollie supports all known payment methods, so you can grow your business regardless of location.

Simplify payments and money management

Drive revenue, reduce costs, and manage funds with Mollie.